There’s a revenue story most healthcare leaders don’t see… It usually starts the same way. Revenue is up. Headcount is up. Systems are in place. On paper, the business looks healthy. Yet cash feels tight, growth has slowed, and leadership meetings keep circling the same question: “Why does it feel harder to scale now than it did at half the size?”

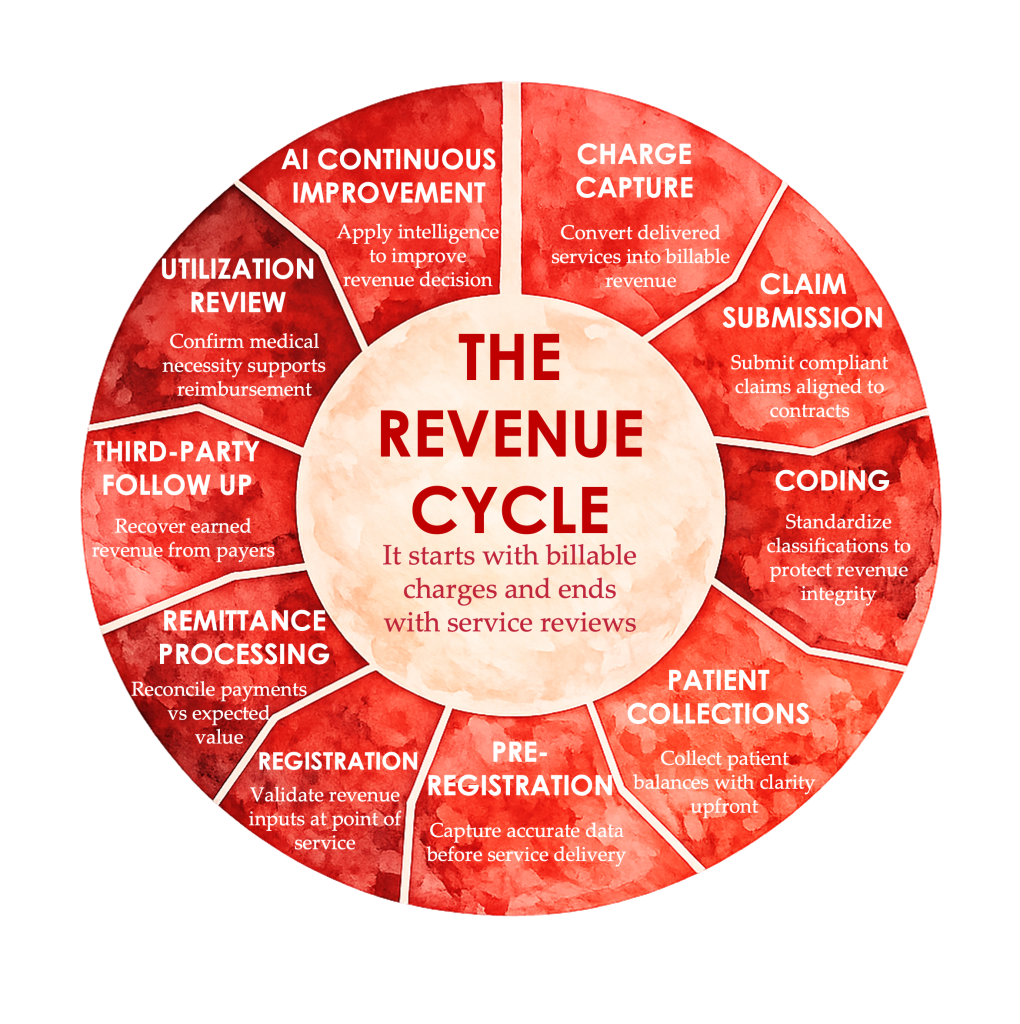

In healthcare (but not the exclusive applicable industry), this moment often triggers a closer look at Revenue Cycle Management (RCM). Leaders pull up the familiar RCM “wheel” (See below) – patient access, coding, billing, collections, reporting – and reassure themselves that each function technically exists. The wheel is intact. The problem must be execution.

That assumption is usually wrong.

The issue isn’t that the wheel is broken. It’s that the wheel is optimized locally-by function, by vendor, by department-rather than architected as a system designed to scale.

And that distinction matters far beyond healthcare.

Revenue Cycle Management Is a System, Not a Department

At its core, Revenue Cycle Management refers to the end-to-end process of capturing, managing, and realizing revenue-from initial customer engagement through final payment and reconciliation. In healthcare, this includes eligibility, coding, claims submission, payment posting, and collections. In SMBs more broadly, the labels change, but the mechanics don’t.

Every RCM wheel attempts to do three things:

- Protect revenue integrity

- Optimize cash velocity

- Create predictability for reinvestment

When any one of those breaks down, growth stalls.

Industry research consistently shows that revenue leakage-caused by process fragmentation, unclear ownership, and misaligned incentives-costs organizations 3-5% of net revenue annually (HFMA; Change Healthcare). For a $50M organization, that’s $1.5M-$2.5M evaporating every year, often invisibly.

That’s not an execution problem. That’s an architecture problem.

Why “Revenue Integrity” Is the Hidden Constraint

Most leadership teams focus on top-line growth. Fewer rigorously manage revenue integrity-the assurance that revenue earned is revenue realized, accurately, completely, and on time.

In healthcare, weak revenue integrity shows up as:

- Inconsistent coding standards

- Payer contract misalignment

- Poor upstream data quality

- High downstream rework and denials

Across SMBs, it looks like:

- Discount creep

- Inconsistent pricing enforcement

- Contract terms not reflected in billing

- Sales closing deals ops can’t efficiently fulfill

Different industries. Same root cause: growth outpacing system design.

The RCM Wheel Breaks When Scale Arrives

Here’s the uncomfortable truth:

Most RCM models are designed for operation, not scale.

As volume increases, small inefficiencies compound. Manual workarounds become institutionalized. Reporting lags reality. Leaders rely on lagging indicators instead of leading signals.

The wheel still spins-but it wobbles.

This is why organizations with strong revenue growth can simultaneously experience:

- Rising AR days

- Margin compression

- Cash flow volatility

- Leadership frustration

The wheel isn’t aligned to strategy. It’s aligned to history.

“Revenue problems rarely start in billing. They start when leadership mistakes functional coverage for system design.”

– Sam Palazzolo, Managing Director, Tip of the Spear

RCM as a Scaling Discipline, Not a Back-Office Function

High-performing organizations treat Revenue Cycle Management as a cross-functional growth system, not a downstream cleanup function.

That means:

- Revenue integrity is owned at the executive level

- Contract economics are operationalized, not assumed

- Data flows forward, not backward

- Incentives reinforce system health, not local optimization

In healthcare, this shift consistently correlates with:

- Lower denial rates

- Faster cash realization

- Improved forecasting accuracy

In SMBs more broadly, it unlocks something just as valuable: decision confidence.

When leaders trust the revenue engine, they invest faster, hire earlier, and scale with intention instead of caution.

Why Stalled Growth Is Usually Structural

For $5M-$100M organizations, stalled growth is rarely about ambition or effort. It’s about structural constraints that were invisible at smaller scale.

Revenue Cycle Management is often where those constraints surface first-but not where they originate.

They originate in:

- Strategy that outgrows operating cadence

- Leadership bandwidth stretched too thin

- Processes built for survival, not scale

- Financial systems optimized for reporting, not insight

RCM is the mirror. Not the root cause.

What Leaders Need to Internalize

Let’s bring this home.

- Revenue Cycle Management is not a wheel to maintain-it’s a system to architect.

- Revenue integrity is the difference between growth that compounds and growth that leaks.

- Stalled organizations don’t lack effort; they lack alignment between strategy and execution.

- The same RCM principles that constrain healthcare systems quietly stall SMBs across industries.

If revenue feels harder than it should, the issue isn’t effort.

It’s structure.

And structure can be diagnosed.

Sam Palazzolo, Managing Director @ Tip of the Spear

Fractional CRO / CRMO · Revenue Architecture & Scale